In the ever-evolving Australian real estate market, a notable trend is challenging conventional views on property investment. Distinct differences are emerging between the stagnant or declining house prices and the surging values of undeveloped land.

Don Harb, Chief Data Officer at National Property Group, has uncovered surprising patterns that deviate from typical market expectations. A significant finding is the rapid increase in land values compared to house prices, highlighting an unexpected shift in investment focus.

In Australia, the significance of undeveloped land’s value is crucial. It is assessed based on the land’s worth without any structures or improvements, unlike house value, which encompasses the entire property. This distinction is vital for determining land tax, a charge primarily levied on rental property owners, though usually exempt for their primary residences. However, it’s worth noting that land tax rules can vary by state or territory.

A case study in Blacktown, a suburb west of Sydney, vividly illustrates this disparity. Over the past five years, house prices in Blacktown have increased by a mere 5%, while the value of undeveloped land has skyrocketed by an impressive 33%. This significant rise in land value leads to increased land taxes and other expenses, complicating the profitability of rental properties. As a result, this may drive up rents and decrease the availability of rental properties as investors search for more lucrative opportunities.

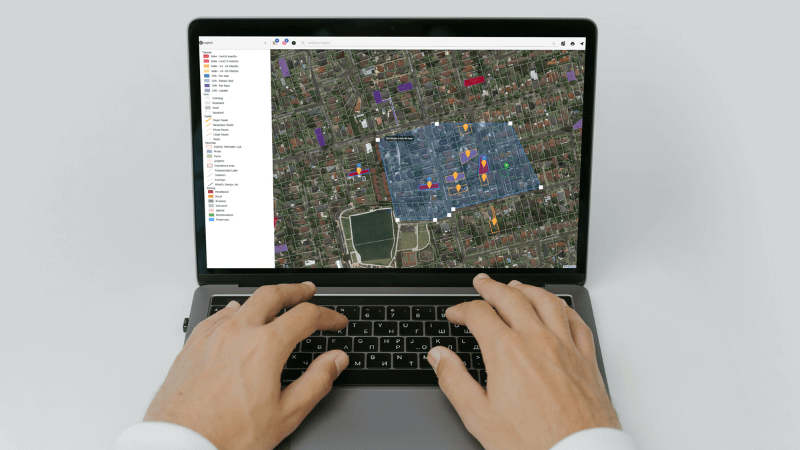

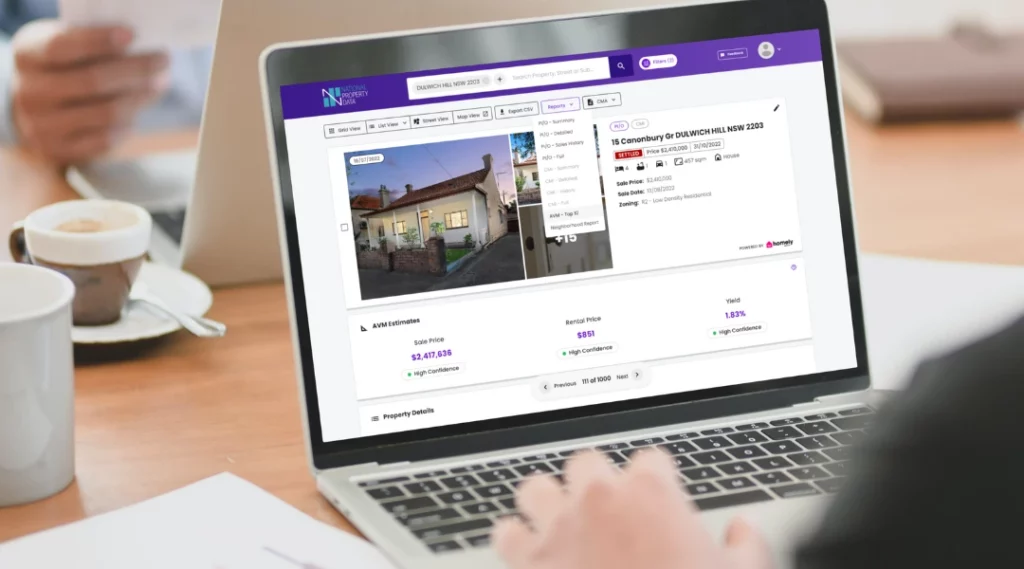

National Property Group serves as an essential resource for real estate agents and investors, offering insights into investment opportunities, such as redevelopment projects on multi-lots. Their detailed property data platform is crucial for identifying areas with potential value appreciation.

Furthermore, agents have an opportunity to assist investors in reducing their land tax bills. By strategically combining several properties into one, investors can enhance their profitability, benefiting both agents and the agencies they represent. This approach fosters stronger relationships between property professionals, enriches their property listings, and enhances their portfolio of rental properties.

Collaboration with developers is also pivotal. Rob Flux from the Property Developer Network, encompassing a broad network of current and future developers, emphasises the critical role agents play in identifying and categorising investment opportunities. These opportunities range from projects with varying degrees of investor involvement to those where investors can take a more hands-off approach or manage projects directly.

Such partnerships are a wise strategy for long-term success. National Property Group’s advanced data platform equips real estate agents and developers with the tools to assess a property’s development potential, enabling agents to not only increase their clients’ profits but also navigate them through the shifting market dynamics.

In summary, as the property investment landscape in Australia undergoes these complex changes, it’s imperative for agents and investors to adapt their strategies. Understanding the interplay between house and land values, and leveraging the right tools and partnerships, is essential for thriving in this dynamic market.

Discover more opportunities with NPD today.

Request a Callback Today

NPG Contact Lead Form

"*" indicates required fields