4 min read – Underquoting in real estate

Legislation referred to in this article applies specifically to NSW.

If you’ve ever been to a weekend barbeque in Australia, you’ve probably been asked about underquoting or overheard someone who doesn’t work in the property industry talking about it.

No doubt, someone holding a beer in one hand and a sausage sandwich in the other has shared a tale about a recent auction, where the agent told them the property would go for around X dollars, only to find the very first bid was tens, if not hundreds of thousands of dollars higher.

Now, as you know, no one person can control demand. They can’t control market fluctuations, pandemic viruses, weather events or any other factors that can affect the outcome of an auction.

But you also know, as experts in the field, they can draw on the resources they have, to price the property according to the market at the time. They can share the same asking price or a range with the top value no higher than 10% above the estimated selling price, with the buyer.

If they don’t do this, they may be underquoting.

Revisiting underquoting

Buyers, sellers and agents alike have all suffered some confusion when trying to understand underquoting legislation, but over recent years, as training has increased, few, if any agents, have any reason not to understand the requirements.

Put simply, underquoting in real estate is when a property agent tells a buyer (whether in writing or in person) a price for a property that is lower than the estimated selling price he or she has listed in their sales agreement with the property owner.

Underquoting is illegal as it can mean buyers waste their time and that of other professionals, like finance brokers, as they prepare to buy a property they either can’t really afford or that will cost an amount they aren’t prepared to pay.

To adhere to the law, when listing a property, among other rules, an agent must base their estimated selling price on evidence such as recent sales of comparable properties. They cannot give vague statements, like ‘priced over’ and they have to keep a record of all prices they tell people, whether they tell them in writing or vocally.

Where the confusion comes in is our barbeque situation. Our friend with the sausage sandwich was likely completely accurate – the agent may have told him a price lower than what the property sold for.

But if the price he was told wasn’t below the price or range the agent had in their sales agreement, this is likely not underquoting, it’s just the often-unpredictable outcome of auction.

If the agent had agreed to an estimate of, for example, $800,000 with the property owner in his agreement, and had then told our beer-wielding friend that he expected the property might sell for $700,000, just so he could have more buyers show up, this would likely be underquoting.

What is an Automated Valuation Model?

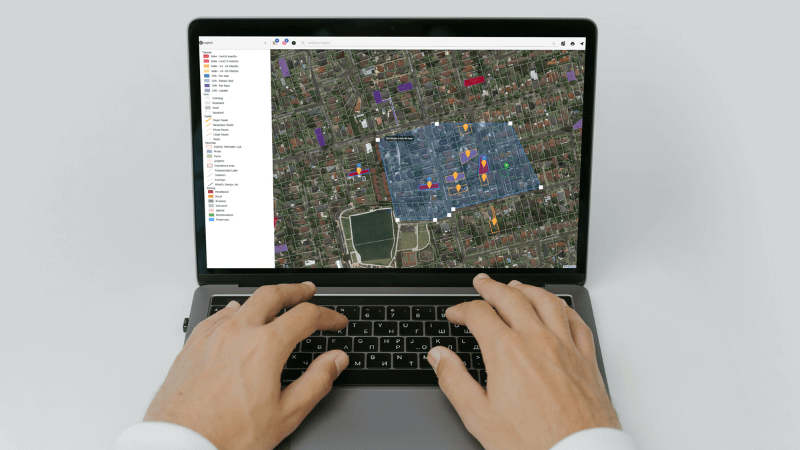

An Automated Valuation Model (AVM), like the one in the National Property Data platform, is a piece of software that helps a property professional, or a consumer, calculate an estimated asking price for a property.

Often using machine learning and smart algorithms, it will draw on market conditions and/or comparable properties and trends over time to suggest a price to the agent or consumer.

In the case of an agent, you can then take this to your vendor and include it in your sales agreement.

Why aren’t all AVMs built equal?

If you look closely at AVMs, most have a disclaimer relating to the accuracy of the pricing they have suggested. The reason for this is that most are purely machine generated and they can only rely on the data available to calculate pricing.

So, what if some of those comparable properties or that market data they relied on doesn’t factor in recent upgrades to a property, new improvements, or a pair of brothers who took an excavator to a house and left is partly demolished?

The best AVMs are those that draw on both quality data, and expert, local insights to deliver the most accurate pricing.

How does National Property Data’s AVM work?

National Property Data’s AVM can be completely automated, as suggested by the name, allowing an agent to calculate a price, based on comparable properties, in a just a few clicks.

What’s unique about it, is it can then be manually ‘tweaked’ by a local expert who knows that one property has a new kitchen, and that other property is now across the road from a new train station, so all factors can be taken into consideration.

An agent can take the guidance of machine learning and go with the comparable properties suggested by the platform, or they can manually select and unselect properties to create a custom list of comparable properties that are most like the one they hope to offer for sale.

Once the price is generated, they can continue to add their expertise to the process by making further tweaks until the new estimated selling price is not only evidenced by recent sales, as is required by legislation, but presents a much more accurate indication of pricing.

How does an AVM help with underquoting?

An AVM offers two great benefits that help both agents and consumers.

Firstly, by enabling an agent to add local expertise to smart algorithm-based estimated pricing, they can present a price they genuinely feel is appropriate for the property, its condition and the market right now.

As the market changes and new properties are sold, they can easily and quickly select new properties and unselect old properties to reassess the value, adjust it in their sales agreement (with the property owner’s ok) and keep the estimated selling price relevant and up to date.

AVMs are also available to buyer’s agents, meaning they too will be able to research, find comparable recent sales, add their local knowledge and calculate a more accurate estimated selling price. They can use this to inform their buyers if the price quoted by a selling agent seems unrealistic so the buyer can make an informed decision.

Clear pricing that just makes sense.

Sign up to National Property Data and receive unlimited access to 40 years of property history and insights, industry leading Mapping, customisable CMA builder, automated valuation and more.

"*" indicates required fields